Stuck with payday loans or high interest short term loans? Thanks to recent changes in financial regulations, many people can get a shot at recovering money stolen through PPI mis-selling, unfair charges, or inadequate affordability checks by credit companies.

New guidelines force lenders to be more careful and disclose more information, so if you have been treated unfairly, there may be money for you. If you are struggling with high interest charges or being charged for things you may not have known you were being charged for, now is the time to learn your rights and where to turn to get back what may be rightfully owed to you. Begin your way of financial freedom with the professional support and the clear plan of salvation.

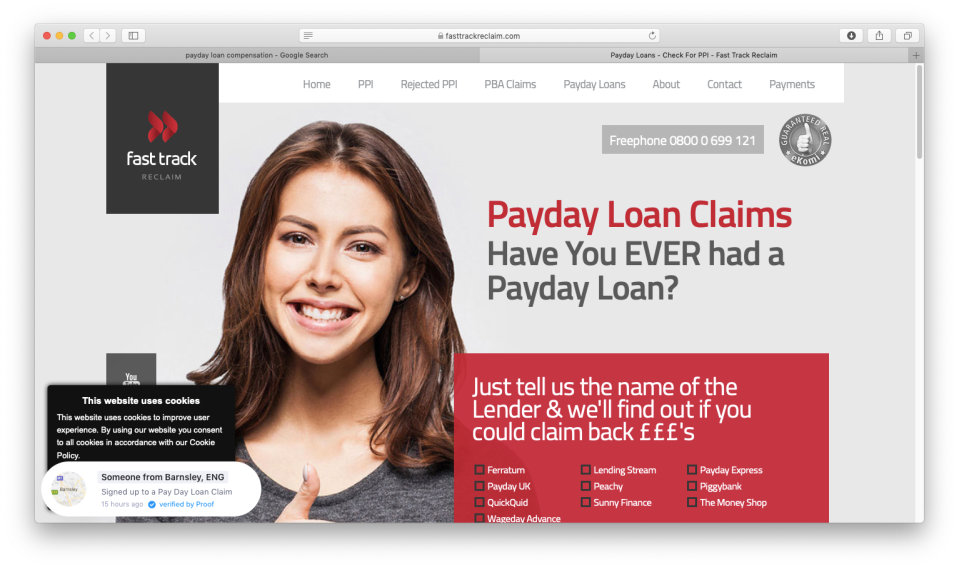

Fast Track Reclaim: Your Partner in Short Term Loan Claims

Fast Track Reclaim offers professional services in short term loan claims that may take some time to be resolved. A significant number of customers are struggling with the loans they were sold, additional charges, or where lenders did not conduct proper affordability checks.

As a result of client satisfaction, Fast Track Reclaim has implemented a clear and concise process that includes an initial consultation which is free, review of documents and claim support throughout the process. They work under the no win no fee arrangement where the client is only required to pay fees when the claim is won, thus affordable and less of a challenge. Call Fast Track Reclaim today to find out how you can get back money from short term loans.

- Professional Claims Support: Specialized assistance for those affected by unfair short-term loan practices.

- Clear Process & No-Win, No-Fee: Initial free consultation, document review, and a no-win, no-fee arrangement make claiming accessible.

- Start Your Claim Today: Contact for expert guidance and find out how to recover money from unfair loans.

Why Can I Now Claim on Payday Loans? by Fast Track Reclaim

More recently, the rules concerning the operation of payday loans have become much stricter, enabling many individuals to seek redress for unfair treatment. Fast Track Reclaim is here to provide an understanding of why this is now possible and how they can help.

Awareness of the Amendments of the Laws:

The FCA has recently tightened its measures to prevent consumers from being exploited through borrowing products. These changes include:

- Affordability Assessments: Currently, loan providers are mandated to evaluate the borrower’s financial position in order to determine whether it will be possible for him or her to repay the loan without suffering extreme financial difficulties.

- Capping Interest Rates: Payday loans have maximum interest rates that mean that the total charges that can be levied on a borrower cannot be excessively high.

- Increased Transparency: The mis-selling is less likely to happen because the lenders are required to expose all the details of the loans such as fees and repayment periods.

Take Action Now: Your Path to Compensation with Fast Track Reclaim

Therefore, the recent modifications in laws governing the issuance of payday loans have enabled many consumers to demand compensation for the unfair treatment. Fast Track Reclaim is able to provide the professional advice, support and satisfaction to those who find themselves having to go through this often confusing and bewildering process.

Through proper assessments and specialized support, Fast Track Reclaim specializes in mis-sold loans, fees that are not disclosed, and reckless credit facilities. If you have had it tough with payday loans, now is the best time to stand up and possibly fight for what you may be entitled to. Call Fast Track Reclaim today for the first step towards getting back your money and regaining your sanity.

- New Consumer Rights: Legal updates empower consumers to reclaim money from unfair loans.

- Expert Guidance & Support: Fast Track Reclaim provides thorough assistance in a complex claims process.

- Fight for What’s Rightfully Yours: Start the journey to financial relief with professional support for mis-sold loans and undisclosed fees.